Not known Factual Statements About Baron Tax & Accounting

Table of ContentsThe Of Baron Tax & AccountingThe Basic Principles Of Baron Tax & Accounting 10 Simple Techniques For Baron Tax & AccountingThe Baron Tax & Accounting PDFsThe 5-Minute Rule for Baron Tax & Accounting

Plus, bookkeepers are anticipated to have a respectable understanding of mathematics and have some experience in a management role. To become an accountant, you have to contend least a bachelor's degree or, for a higher level of authority and knowledge, you can come to be an accountant. Accountants need to additionally meet the stringent demands of the bookkeeping code of technique.

This makes certain Australian business proprietors obtain the best feasible monetary suggestions and management feasible. Throughout this blog site, we have actually highlighted the big distinctions between accountants and accountants, from training, to roles within your company.

More About Baron Tax & Accounting

Accounting firms do more than simply accounting. The solutions they give can make the most of earnings and support your financial resources. Organizations and people must consider accounting professionals a vital element of financial planning. No accountancy company provides every service, so guarantee your consultants are best suited to your particular needs (ATO tax return help online). Understanding where to start is the initial obstacle

Accountants Can encourage clients on making tax regulation work for them. All taxpayers have the right to depiction, according to the internal revenue service. Accounting firms can aid organizations represent their interests with appointment for filing treatments, details demands, and audits. The majority of firms do not function alone to accomplish these answers. They function together with lawyers, financial organizers, and insurance specialists to create an approach to reduced taxi payments and prevent expensive blunders.

(https://baronaccounting.weebly.com/)

Accounting professionals are there to calculate and update the collection amount of money every employee gets consistently. Keep in mind that holidays and healths issues impact payroll, so it's an aspect of the company that you should continuously update. Retired life is also a considerable element of payroll monitoring, particularly considered that not every employee will certainly intend to be enrolled or be eligible for your firm's retired life matching.

The 5-Second Trick For Baron Tax & Accounting

Some loan providers and capitalists need decisive, critical choices in between business and shareholders following the conference. Accountants can additionally be existing here to assist in the decision-making procedure. Prep work involves releasing the earnings, capital, and equity declarations to evaluate your present monetary standing and condition. It's easy to see just how intricate audit can be by the number of skills and jobs called for in the role.

Little businesses commonly encounter one-of-a-kind economic obstacles, which is where accountants can give very useful assistance. Accountants supply a range of solutions that help businesses stay on top of their finances and make informed decisions. digital tax agent for individuals.

Therefore, expert bookkeeping helps avoid expensive blunders. Pay-roll administration includes the administration of staff member incomes and salaries, tax obligation reductions, and benefits. Accountants make certain that employees are paid precisely and promptly. They determine payroll tax obligations, take care of withholdings, and ensure compliance with governmental policies. Handling incomes Handling tax obligation filings and settlements Tracking employee advantages and reductions Preparing payroll reports Appropriate payroll management stops problems such as late payments, inaccurate tax obligation filings, and non-compliance with labor laws.

Little Known Questions About Baron Tax & Accounting.

Tiny service proprietors can count on their accountants to take care of complicated tax obligation codes and laws, making the declaring process smoother and a lot more effective. Tax obligation preparation is another necessary service supplied by accounting professionals.

Accounting professionals help tiny companies in determining the worth of the firm. Approaches like,, and are used. Precise assessment helps with offering the organization, safeguarding car loans, or drawing in investors.

Clarify the process Visit Your URL and answer concerns. Fix any kind of inconsistencies in documents. Guide business proprietors on best methods. Audit assistance helps companies go via audits efficiently and successfully. It decreases stress and anxiety and mistakes, ensuring that companies satisfy all necessary policies. Statutory compliance includes sticking to laws and laws associated to service procedures.

By setting practical financial targets, companies can assign sources effectively. Accounting professionals guide in the application of these approaches to guarantee they align with the company's vision.

Indicators on Baron Tax & Accounting You Need To Know

They make sure that services adhere to tax obligation laws and market policies to stay clear of penalties. Accounting professionals also suggest insurance policies that supply security versus potential dangers, guaranteeing the company is secured versus unanticipated occasions.

These devices help tiny services maintain accurate records and streamline procedures. It aids with invoicing, pay-roll, and tax obligation prep work. It supplies several attributes at no cost and is ideal for startups and little businesses.

Romeo Miller Then & Now!

Romeo Miller Then & Now! Anthony Michael Hall Then & Now!

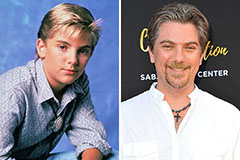

Anthony Michael Hall Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now!